close

Choose Your Site

Global

Social Media

1. CME Group Introduces Molybdenum Oxide (Platts) Futures:

On March 13, 2023, CME Group announced the first trades of Molybdenum Oxide (Platts) futures. A total of 90 contracts were traded, with open interest extending out to February 2024. These futures are designed for managing risks associated with the energy transition.

Molybdenum has various applications, including enhancing steel performance. As demand for clean power technologies rises, the material’s importance is expected to grow. Molybdenum futures allow the industry to hedge against volatile prices and provide crucial price signals in an emerging market.

2. Price Movements:

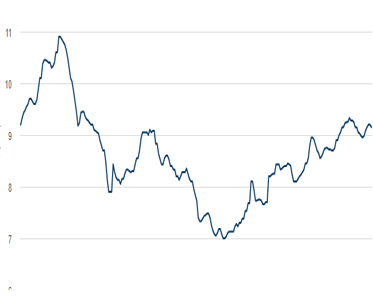

The Platts daily dealer molybdenum oxide assessment recently rose to $11.90-$12.00 per pound. In South Korea, a container load of oxide powder was traded at $12 per pound CIF Busan. Additionally, a container load sale occurred in India at the same price.

The Platts weekly dealer molybdenum oxide price was assessed at $13.20-$13.50 per pound.

3.Nanomaterials in Nanomedicine:

Molybdenum oxide nanomaterials have gained attention in nanomedicine due to their ability to carry oxygen and form various molybdenum oxides (MoOₓ, where 1 < x ≤ 3). These materials exhibit unique morphologies, structures, and properties.

4. Contract Details:

Molybdenum futures have a contract size of 1,322.77 pounds, equivalent to 60% of one metric ton. They are financially settled based on the Platts Molybdenum Oxide Daily Dealer (Global) assessment, a key reference point for pricing molybdenum oxide and downstream products across the supply chain. These futures are listed by and subject to the rules of COMEX.